Selling a business is often a defining moment for entrepreneurs, representing years of hard work, investment, and dedication. While the prospect of …

Blogs

Financial Freedom, Starts here!

Want to hear something really strange? The IRS doesn’t take anything from you. You’re actually giving it to them—willingly. Every year, your …

As a business owner, you’re already paying for insurance—but is your current setup working for you, or are you just cutting checks to a third-party insurer with …

When it comes to real estate investing, one of the most important distinctions is whether your investment activities are considered active or passive. This classification not only …

When it comes to advanced tax planning, many business owners and investors are unawareof the powerful tools available to reduce their tax burdens, protect their assets, …

As an entrepreneur, maximizing your profits and minimizing tax liabilities are likely top priorities, especially when it comes to selling your business. …

When selling a business, one of the most effective strategies to reduce estate taxes and maximize the benefits for your heirs is …

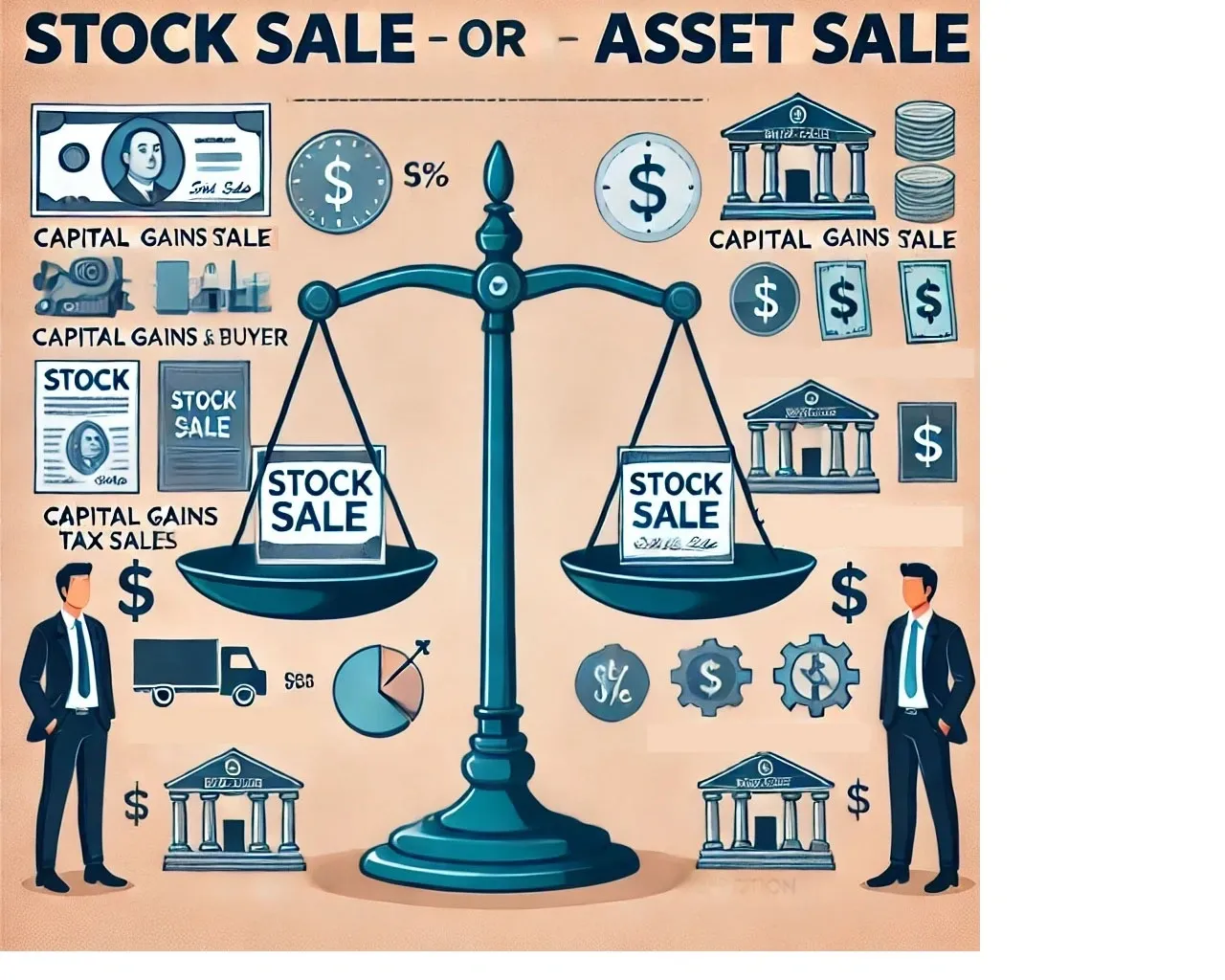

When selling a business, the transaction can generally be structured as either a stock sale or an asset sale. Each approach has …

How High-Net-Worth Individuals Can Leverage Charitable Giving for Maximum Tax Benefits For high-net-worth individuals, charitable giving is not only a way to …

In the ever-evolving landscape of corporate finance, businesses are continually seeking innovative strategies to manage risk and minimize tax liabilities. One approach …

Recent Posts

-

Savoury Greenhouse – Lien Resolution & Bookkeeping Case studyAugust 5, 2025/0 Comments

Savoury Greenhouse – Lien Resolution & Bookkeeping Case studyAugust 5, 2025/0 Comments -

Light House Realty – CFO case studyAugust 5, 2025/

Light House Realty – CFO case studyAugust 5, 2025/ -

Unlocking the Power of the Charitable Holding CompanyJune 16, 2025/